There are reportedly 570 million farms in the world of which more than 500 million are family farms. Among these farms, an estimated 475 million are small farms, less than 2 hectares in area, cultivated by smallholder farmers. About 3 billion rural people live in these farms, working on their plots to supply food to a substantial proportion of the world’s population while also producing food for household consumption. Even so, the economic choices that these smallholder farmers have at their disposal are restricted given limited access to good quality inputs, pricing information and most specifically, finance.

However, the increasing access to mobile phones among smallholder farmers cannot be overemphasized. The mobile phone penetration rate in the developing world, on an average, has crossed the 80% mark. Fintech firms, banks and mobile network operators acknowledge this phenomenon and have come forward with mobile phone-led interventions to deliver crucial services to smallholder farmers resulting in expanding their economic choices as they test and try innovative business models in many developing markets with reasonable rates of success. Examples across the developing world abound. M-pesa in Kenya, Smart Money in Uganda and Tanzania, Maano in Zambia, Tarfin in Turkey, Vina Phone in Vietnam and Prabhu Money in Nepal are some notable success stories. These m-agri platforms and services have focused on ground-up approaches for the most part, relying on insights from the smallholder farming community to constantly iterate and improve their product service/design delivery, reaching thousands of users rapidly. M-agri services are therefore, transforming the smallholder agriculture landscape, bringing more and more smallholder farmers to the center of the financial marketplace and providing them more linkages and access to markets.

At Amarante, we specialize in the design and delivery of m-agri services among other digital financial services and we enable the following three m-agri use-cases:

1) The financial transaction in itself,

2) Information exchange both at the micro(user) and macro(stakeholders) level.

3) Extension services (beyond transactions) that enable access to markets.

The below are some highlights from one of our recent experiences with Digital Financial Services for agriculture in Ivory Coast :

Digitizing payments to Cocoa farmers in Cote d’Ivoire

For the last 5 years Cote d’Ivoire has witnessed impressive GDP growth, clocking 7.8% in 2017. Côte d’Ivoire’s economic growth has been accompanied by the mobile phone revolution. According to a GSMA report, the share of adults with a mobile money account in Cote D’Ivoire surged to 40% in mid-2012. Mobile money, therefore is becoming the quotidian way of transacting for a majority of Ivory Coasters.

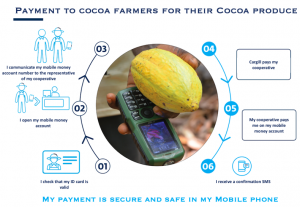

Against this backdrop, in 2018 Amarante worked alongside development partners, Cargill and IFC, on a project that focused on fostering mobile-based payments to cocoa farmers as a substitute for cash payments. While Cargill strives to pay farmers digitally for their produce (via the agri cooperatives and in partnership with digital finance service providers), IFC funded some of the on-field sensitization work as the latter was deemed important in order to streamline enrolment, gain farmers’ trust in the service and achieve more adoption and overall impact.

Amarante and its local partners liaised largely with the cooperatives, training them on best digital financial services (DFS) practices, which were then disseminated to the farming community. The team also assisted with building positive perceptions about the use of the mobile as a channel for payments, directly facilitating enrollment of farmers with relevant service providers (mobile network operators, banks,…), and providing training on usage and adoption of m-agri services together with after-sales support.

This project of bringing digital financial services to smallholder farmers, however, is not without its challenges. Our consultants on the field reported a few impediments to promoting the use of theses digital payments:

- Given that the team relies on the existing farming community and cooperatives in order to reach smallholder farmers, a collaborative effort across different actors in the cocoa value chain is indispensable. However, this has been difficult to achieve. On the one hand, “lead farmers” (personnel deployed by the cooperative to work with a group of individual farmers) are not always available to support DFS sensitization on the field. On the other hand, when the cooperatives’ personnel are not directly involved in mobilizing these efforts, it gets difficult for external parties (such as a DFS sales force or consultants) to coordinate work directly with farmers.

- Occasionally, we felt that the cooperatives’ incentives may not be aligned with those of the service provider or that of smallholder farmers. In such a scenario, galvanizing farmers to use mobile money/digital accounts becomes a daunting task especially because farmers themselves bank on a buy-in from the cooperative in order to wholeheartedly accept the service. Therefore, reaching farmers directly, is not only a colossal task but can also turn out to be rather ineffective.

- Some smallholder farmers live in areas that are beyond the service provider’s reach, often lacking mobile phone coverage. This makes it impossible to enable the opening of mobile wallets. Moreover, some service providers do not have wide agent networks, precluding a simple enrollment process and the much needed cash in/cash out service.

Despite these challenges, the enthusiasm among smallholder farmers to dabble with technology and try something new is palpable.

Our experience on this and other m-agri projects leads us to believe that there is a growing need for digital services that address the needs of smallholder farmers through promising service offerings. However, not only does the service/product in itself have to be tailored for their usage; efforts on marketing, awareness building, training etc. need to sit well within the farmers’ setting and field realities.

Moreover, these services cannot be delivered effectively without a supporting ecosystem that includes all relevant stakeholders (in this case Cargill, the service providers, agent networks and field force). In particular, the following factors are vital:

- Mobile connectivity and internet penetration are prerequisites to the successful uptake, usage and adoption of m-agri services.

- Financial/Digital literacy programs that can bring farmers up to speed on digital usage and adoption need to go hand-in-hand with m-agri service delivery.

- Use of ground-up approaches to determine what works for smallholder farmers in their specific context is crucial. Customization of the digital intervention to best reflect the realities of smallholder farmers’ behavior and preferences is imperative to maximize impact. For example, the user interface and user experience for mobile- related services catering to smallholder farmers must be built with a human-centered design approach. Simple things like which icons to choose in order to portray certain events (like making a payment via the mobile phone) or which jargon to use to facilitate easy understanding can make or break an offering. These are as important for use on the actual mobile phone as they are to use on training and sensitization material.

- In order for digital financial services to work continuously for this population, agent networks for cash-in, cash-out and other potential services (like savings, loans, customer support) are a core and indispensable part of the service offering.

At Amarante, we want to build on this excitement and create incentives for the supply-side to further better introduction, enrollment and adoption of m-agri services among smallholder farmers. One recommendation to stakeholders wanting to increase digital usage among smallholder farmers would be to forecast a dedicated budget to recruit and train a field task force, that would work hand-in-hand with the cooperative’s personnel and whose sole objective would be to promote the digital service offering, explain its benefits and train farmers on its functioning. This task force should comprise of local community networks and the cooperatives in question. This way, the goals and objectives set are appropriated and owned by the agri-value chain players themselves thereby ensuring better alignment and coordination, which in turn allows for smoother, tangible results on the field.

To read about some other m-agri related work, and the importance of human centered design to improve user experience and interface, look up our blog on Maano, a virtual farmers market