Financial inclusion refers to the process of extending access to financial services to the previously unbanked or underbanked population found mostly in remote areas, in developing countries or among various social groups such as women or migrants. The lack of appropriate access and adapted products and services catering to the 1.7 billion unbanked population (Global Findex, 2017) is due to gaps on both the demand and the supply side. On the demand side (financial services customers), financial illiteracy and weakness of infrastructure such as network coverage, roads, transport, electricity, water and sanitation are the main barriers, whereas, on the supply side, the relatively high cost of establishing appropriate infrastructure (e.g. bank branches in remote locations) to manage small value transactions makes the business usually not viable for financial institutions.

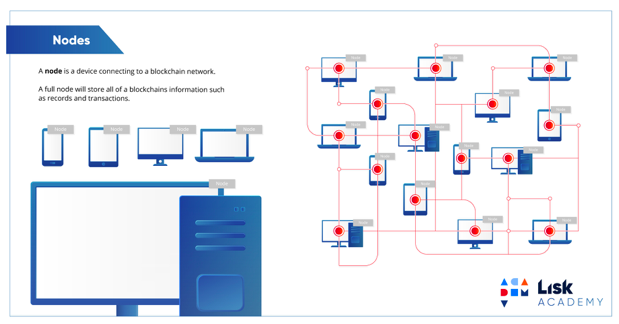

In recent years, many innovations have attempted to bring a solution to increase financial access in emerging countries.Lately, blockchain technology, or the distributed ledger technology (DLT), has been deemed as the next big revolution in improving access to financial services. It essentially is a digital database of economic transactions that uses a network of nodes to ensure transparent recording.

How does it work?

The core functionality of blockchain, that is, the peer-to-peer transfer of value through the distributed ledger technology, rules out the need for third party verification due to the inherent security provided by validation of blocks by consensus, which makes the recording of transactions transparent and efficient, thereby improving payment platforms/functionality for banks. In this context, a ‘block’ or a node refers to an administrator or a computer connected to the blockchain network that validates and relays transactions.

What are the use-cases of blockchain technology?

Although most banks and financial institutions are still in the experimental phase with regard to applications of blockchain technology, many startups have rolled out successful products which rely on this innovation for their core functionality. Some prominent examples in the mobile remittance segment are:

- Ripple, a real-time gross settlement system and remittance network which allows for transfer of value across the world by loading money onto its wallet, through a secure and frictionless payment protocol.

- Known for it’s quick transaction speed, is Stellar, a payment network which facilitates transfers of value between fiat-based currency and cryptocurrencies

- WorldRemithelps migrants send money across the world. Its application can reduce the transaction fees to a global average of 7.45% with a 5% drop.

- Bitpesa, reduces cost, improves the efficiency and speed of payments from and within sub-saharan Africa where businesses can accept customer payments in many forms including mobile money offerings like M-Pesa in Kenya.

Other emerging examples:

- Banks like HSBC and Tokyo Mitsubishi are investing in pilot projects to use blockchain in KYC request processing. Goldman Sachs, Bank of America Merrill Lynch, Royal Bank of Canada, Fujitsu and 3 of Japan’s largest banks are also using it for processes ranging from processing trade finance transactions to clearing and settlement of money transfers between individuals.

- Although international money transfer is the more popular application of blockchain technology, one of its use cases is present in the domestic payments domain. R3CEV is a distributed database technology company which is not only deploying blockchain to deliver real-time payment services, but also conducting research in usage of distributed ledger technology(DLT) in other areas of commerce.

- Komgo SA , a consortium of 15 institutions which includes banks and trading firms, based in Geneva, is launching the world’s first platform that operates on blockchain for financing commodity trading. The platform will first be used for trading crude cargoes in the North Sea and starting early 2019, for agriculture and metals.

- In September 2018, GREX, a private market platform, launched Stockchain for unlisted companies at the National Stock Exchange of India Ltd. (NSE). Stockchain is a hyperledger-based technology that helps in operational and transparency efficiency. It becomes very difficult to have a mechanism for price discovery of unlisted companies or to maintain registry records, amongst other issues. Thus, Stockchain promises a good start for companies to maintain a digital registry and to become public. In addition to the above, the NSE is also testing the use of blockchain for e-voting for listed companies where the voting rights will be ‘tokenized’ i.e a form of digital envelope which allows only end voter to open, preventing forging of data.

- With regards to the development sector, the United Nations World Food Program (WFP) used this for its program called “Building blocks” in Jordan in order to provide cash assistance to refugees. 10,000 refugees can now pay for their food through entitlements recorded on a blockchain-based computing platform.

Has blockchain achieved its full potential?

As seen above, apart from remittance, many of the other use cases for Blockchain are just about launching or in the experiment phase. As a transformative technology, blockchain promises to solve several issues faced by traditional businesses and processes. According to a study, blockchain technology could reduce financial services infrastructure cost by US $ 15 billion to US $ 20 billion per annum by 2022 (Oliver Wyman, Anthemis Group and Santander Innoventures, 2015).

If this what the blockchain technology promises, then one can argue that insitutions focused on the financial inclusion should be widely adopting it on large scale.

A technology that is yet to scale and prove its case

Unfortunately, despite the many advantages and test examples of blockchain deployment, a more universal uptake across regions and especially in the development sector is yet to be seen.

Slow transaction speeds and a lack of standardization threaten to stunt blockchain’s growth. Another area that needs to be further developed is the recourse and consumer protection mechanism to address online fraud or misreporting of payment entries. As with the development of any new (financial) technology, the question of regulation is central. Different central banks have taken varied stands on the technology but there needs to be uniformity regarding some regulations such as anti-money laundering and KYC.

In the access to finance space especially, Blockchain has not yet emerged as a technology that can either solve the acess problem or reduce the cost of infrastructure needed to provide wide spread access to financial services and products. As Greta Bull, CEO of CGAP, pointed out in her article ‘Blockchain: A Solution in Search of a Problem?’, it is clear that there is some growth potential in the applications of blockchain in the high value, low volume money transfer sector, where efficiencies can be gained from using distributed ledger technologies. Clearly in the case of businesses such as WorldRemit or Ripple, cost efficiencies result in lower pricing to the customer. However, for the specific domain of financial inclusion and access to other financial products and services, there aren’t many scaled up successful use-cases yet.

As the market evolves and the industry moves along, we believe we will see the use of blockchain technology in more for-scale development and financial inclusion programs. We look forward to reporting on the progress made by the financial inclusion sector as it further explores relevant use cases of the blockchain technology and its benefits.