Tontines are traditional, informal savings groups that allow groups of women across Francophone Africa and other regions in the world to set aside money on a regular basis with the aim of accessing a larger amount through loans after a certain period of time. Each month women contribute their share of money to the tontine. At the end of each month one of the women in the group will gain the pot as a loan. This allows them to pay for medical expenses, children’s school fees or resources for their local businesses. Across West Africa there are 30 million women who save and access 3 billion dollars* annually through this system. Yet, despite advancements in technology, this age-old practice hasn’t modernized.

Women continue to rely on traditional savings groups to be able to afford expenses related to basic long-term necessities and/or make investments for their small businesses. But what if these women didn’t have to rely on lottery luck to make an investment and grow their enterprise? And what if these women could access financing at the press of a button?

Today, the majority of West Africa’s population remains financially excluded. For a region with over 30% of the population living in absolute poverty, access to finance is essential. However with many citizens having incomes of less than $1.25 a day, they are unable to open bank accounts or build credit scores that qualify them for loans and insurance. Furthermore, banking infrastructure is scarce in rural areas. Many citizens don’t have government-issued identification to access loans and many local businesses are unable to remain viable due to curfews and lockdowns in the region caused by the COVID-19 situation.

Rural agricultural businesses are most severely affected. The OECD predicts that the health crisis will increase the prevalence of food insecure regions across Africa. This will tip more than 50 million people over the edge. The problem is exacerbated as traditional financial institutions are pausing lending activities and investors are less likely to contribute to microfinance as they had in the past.

So how do we ensure that the population of 400 million in West Africa have access to adequate poverty alleviating services? One such fintech working hard in this field is MaTontine. Started in 2015, MaTontine proposes a uniquely African solution to reduce financial exclusion: Digitizing the traditional tontine saving groups with the aim of facilitating access to finance.

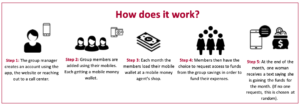

Digitizing this platform saves time, widens the access to micro-finance and allows members to build credit scores and digital identities making them eligible for various financial products and services (micro-loans, micro-insurance,..).

It is for these innovative and impactful use cases that Amarante promotes Digital Financial Inclusion as a pertinent strategy to alleviate poverty. By facilitating access to financial services, such as micro-loans and micro-insurance, poorer communities can start businesses or pay for basic necessities with more ease. In promoting client-centric fintechs that provide digital finance platforms we can integrate the financially underserved into formal systems, offering them quality products and services at affordable price points.

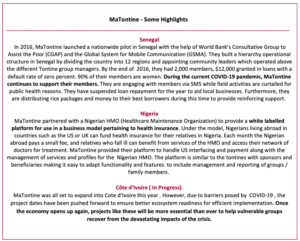

“We are able to reduce the cost of borrowing for the end user by upto 75%” stated Bernie Akporiaye in his interview with Amarante. MaTontine partners with local telecom providers to allow members to receive, refund and use money directly through wallets on their mobile phones. They can register using the MaTontine website, app or call center, as well as through field agents during field activities. Members can retrieve their money in cash from local mobile money agents. The system also utilizes SMS to allow it to be accessible for those without smartphones. Mr. Akporiaye stresses how essential this feature is.“In Sub-Saharan Africa only 20% of people have smartphones and for our target group of women living under 5 dollars a day, that percentage drops down to about 1%”. The MaTontine system is therefore bringing important innovation to local populations in an affordable and accessible way.

Amarante is keen to see success of more fintechs similar to MaTontine. The flourishing of fintechs providing adapted products and services within local community contexts gives opportunities to create meaningful impact on local economies and their people. Encouraging digital financial inclusion as a part of broader capacity-building for vulnerable groups can help them break the poverty cycles. This promotes more inclusive economic growth within countries that are underpinned by better financial health of its population. Amarante believes that creative fintech business models and client-centric offerings, like the ones rolled out by MaTontine, are critical keys to bridging the gaps of financial exclusion.

Unfortunately, fintechs like MaTontine face grave challenges brought about by COVID-19. These challenges are not only on the operational and field side but also on the upstream side, in terms of accessing the appropriate investment and funding to support sustaining and scaling up their business. The creative and passionate entrepreneurs will automatically seek to create models and innovations that can help pivot their business and find opportunities for continued impact and sustainability. On the other side of the spectrum, these models will continue to require investment and funding in order to survive and subsequently thrive.

Amarante strives to help connect the dots between the field (provider and its end customer) and the funder (investors, partners, donors and governments). By being the ears and eyes for both sides, we work on bridging the gap so that the latter can make informed funding decisions that will allow for continued innovative and impactful offers to uplift the lives of local populations across the emerging world.

* Amarante’s discussion with Bernie Akporiaye, founder of the Fintech MaTontine, operating in West Africa